Google Adsense needs your tax information, follow these steps for Canadian Residents that are not US Residents or declare taxes in the US

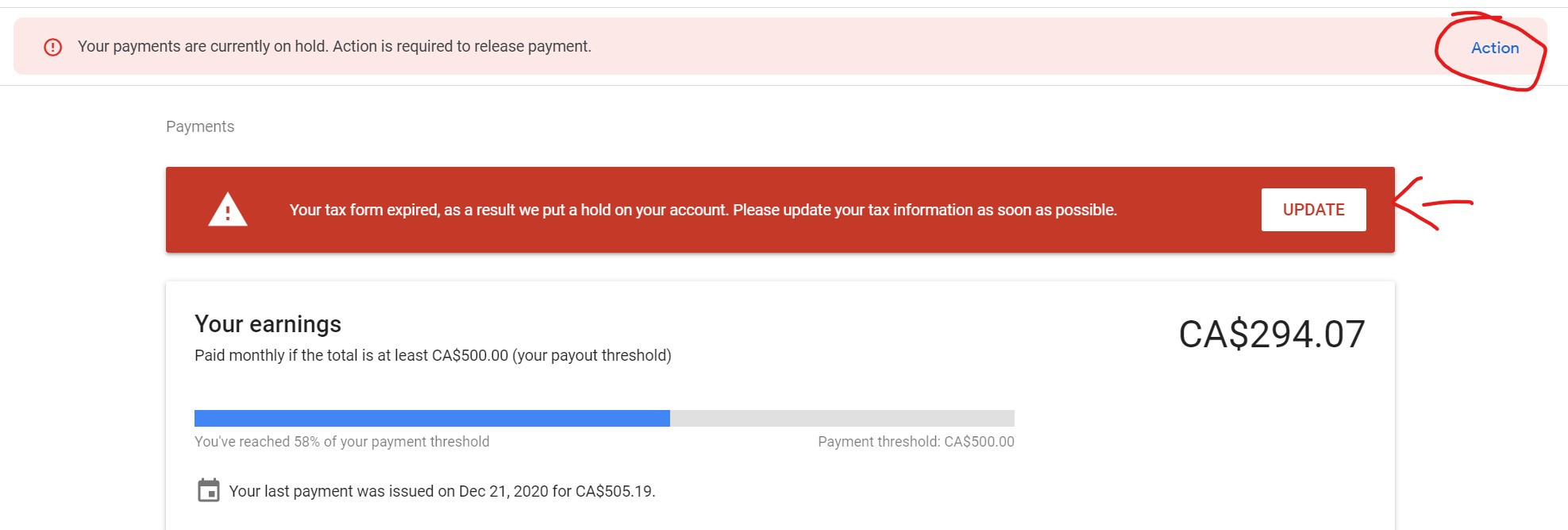

Click on the Action link and then click on the UPDATE button

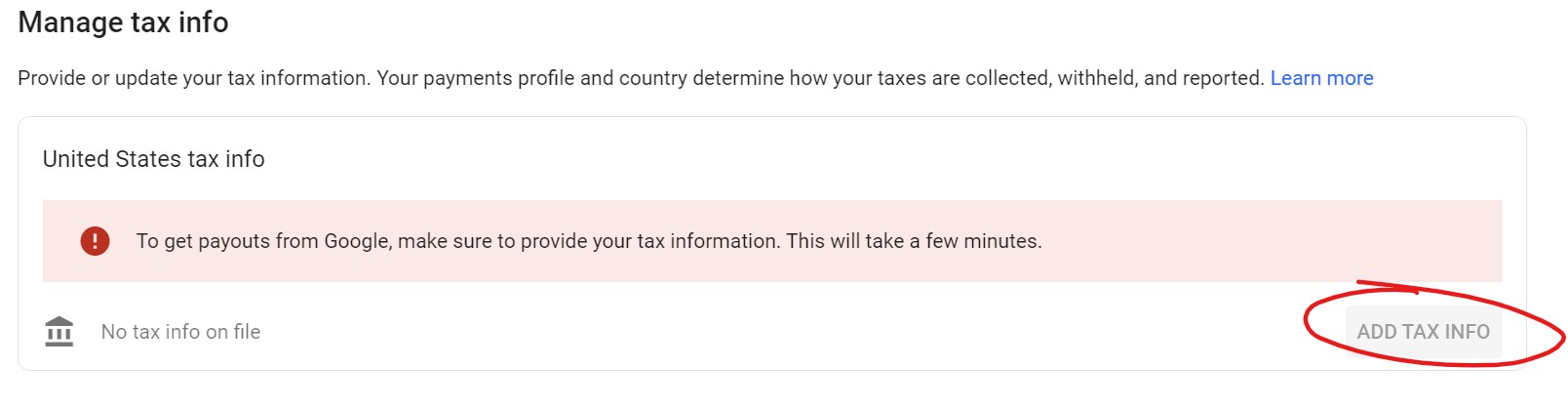

Then click on ADD TAX INFO

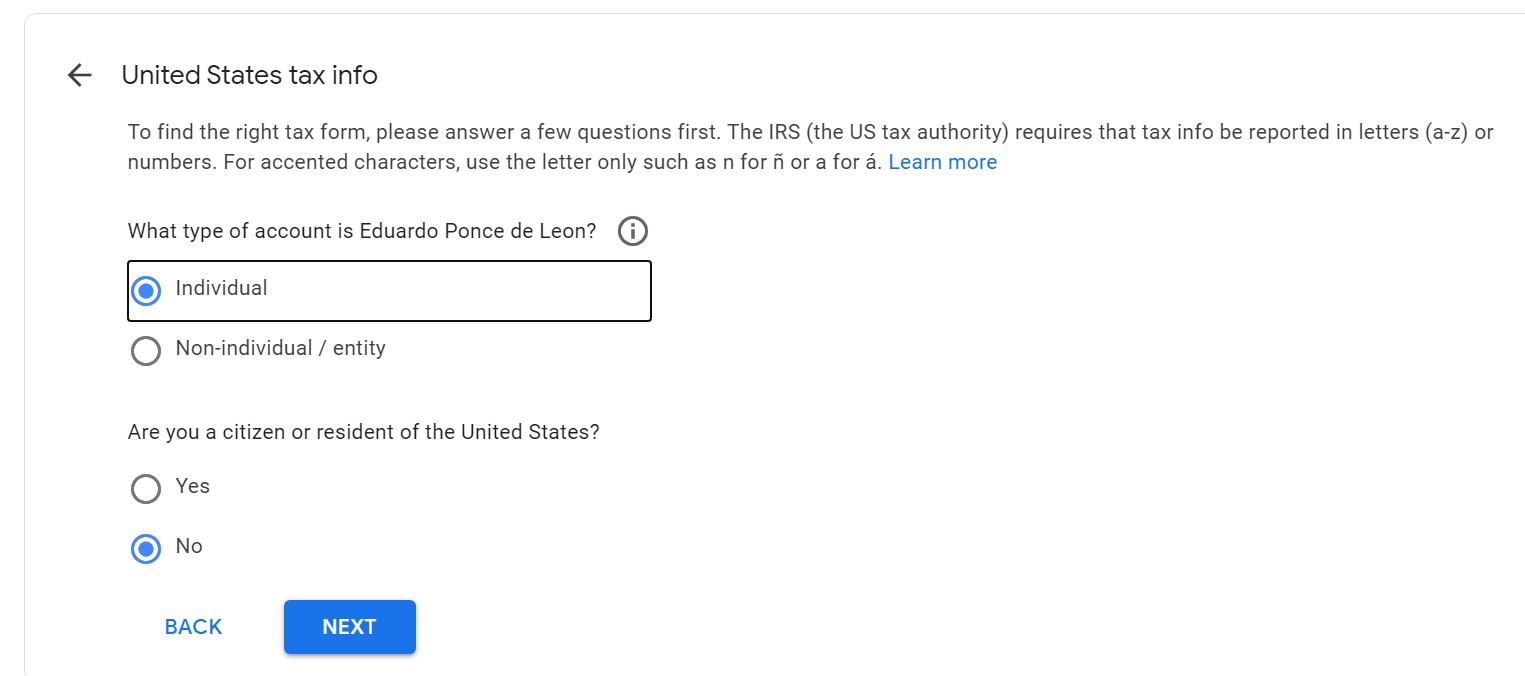

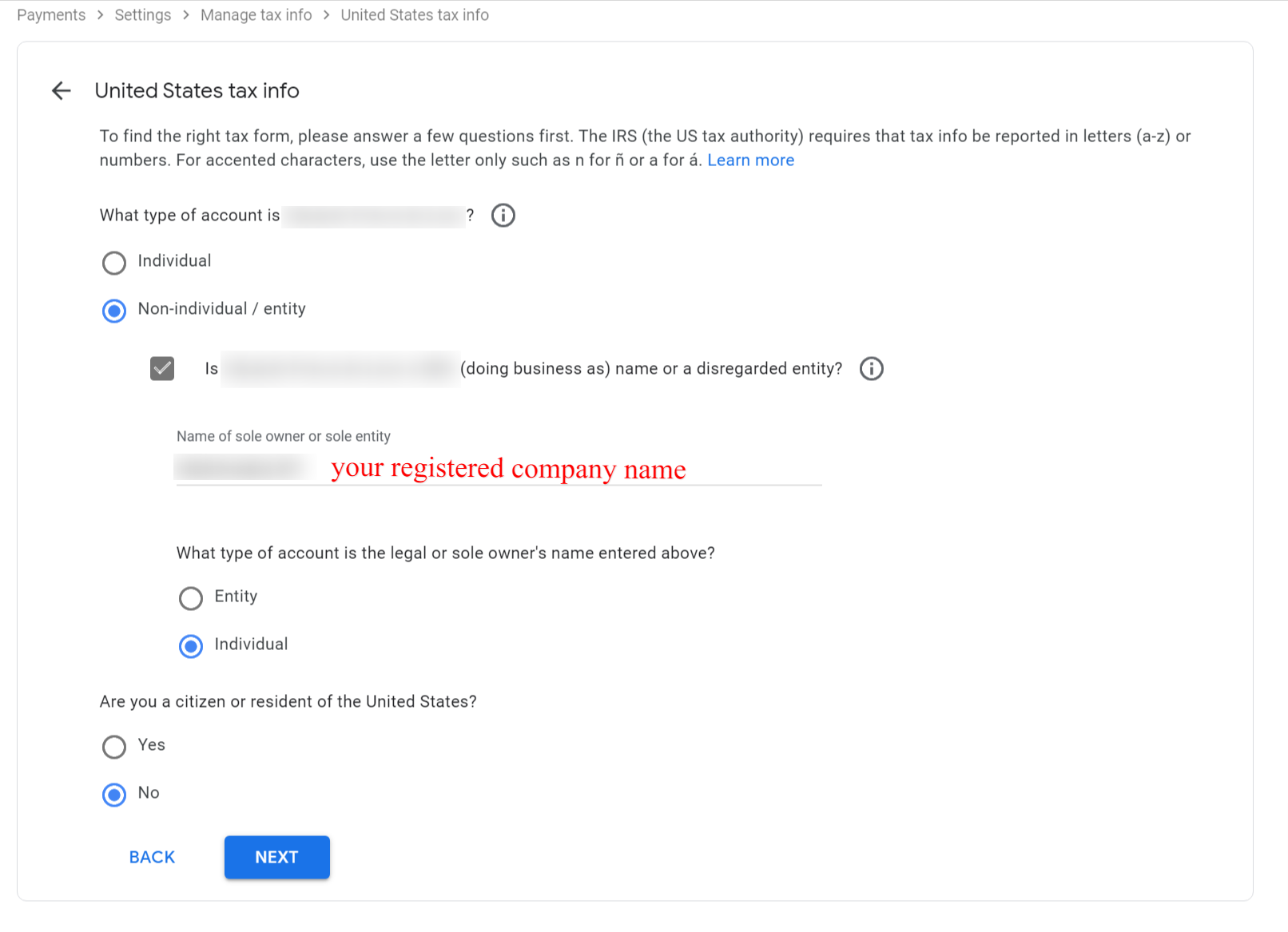

Under United States tax info:

a) if you are an individual that do not have any regresiterd or incorporated company, select individual

b) If you are self-employed maybe with a registered company or you do not have an incorporation opened under your name, then select Non-Individual / entity, check the box Is XXXX DBA(doing business as) name or a disregarded entity? Add the name of your registered company, and select Individual under the type of account. Select No if you are not a resident of the United States.

c) If you are a corporation in Canada not doing business as an individual, select Non-idividual, and do not check the box for DBA, then select Entity fotr the type of account.

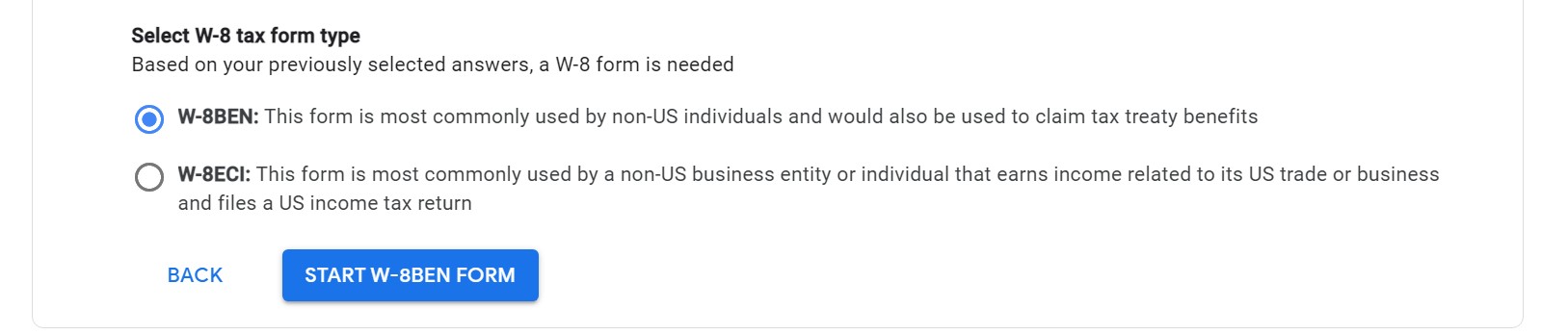

If you do not have any other earnings from the US or you do not file income taxes in the US, select the W-8BEN form, this form will allow us to select the right tax exemptions.

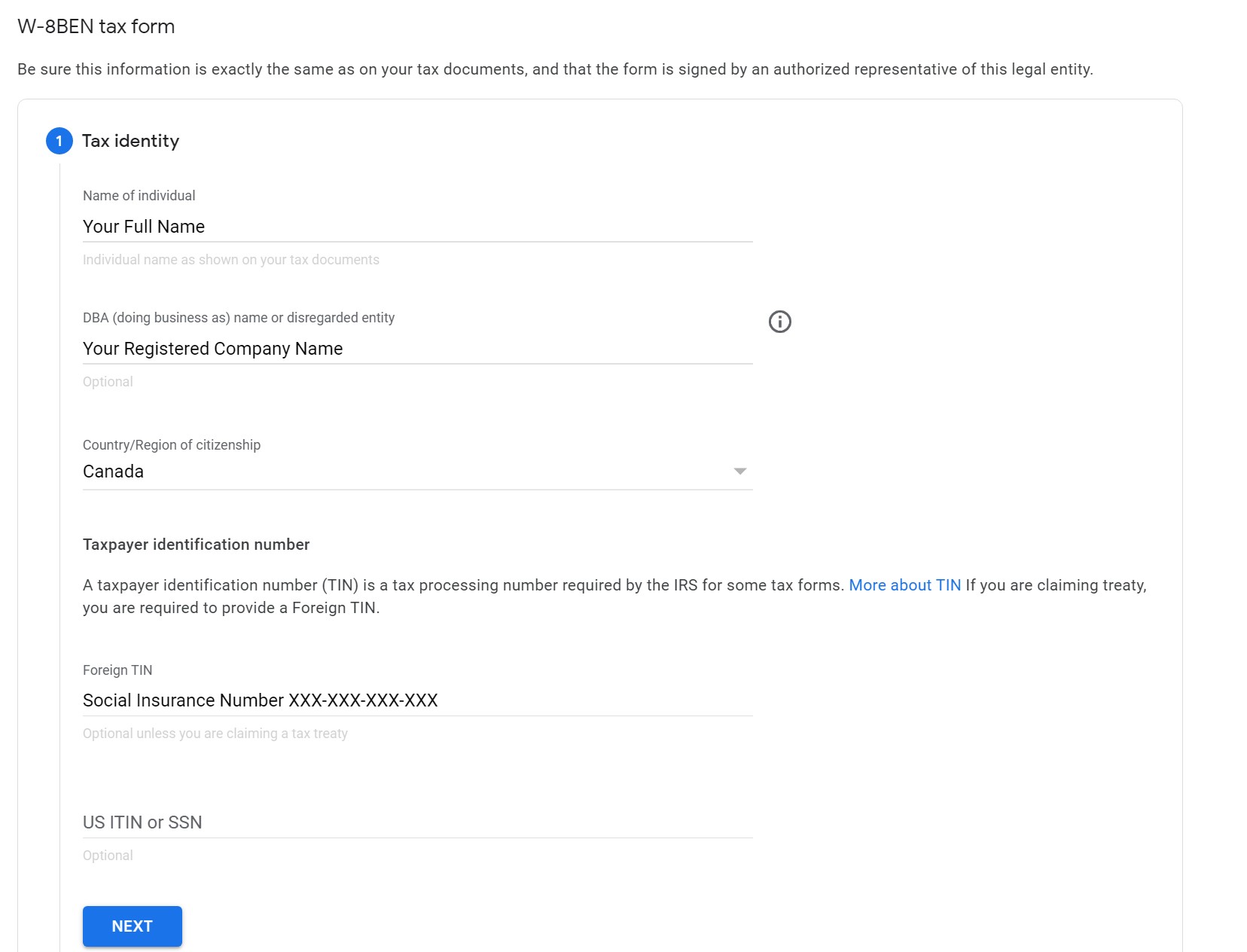

On the first step, Add your full name, your registered company name (optional if you selected Non-idividual / entity before), Canada as the country and under TIN add your Canadian Social Insurance Number. ITIN or SSN can be left empty.

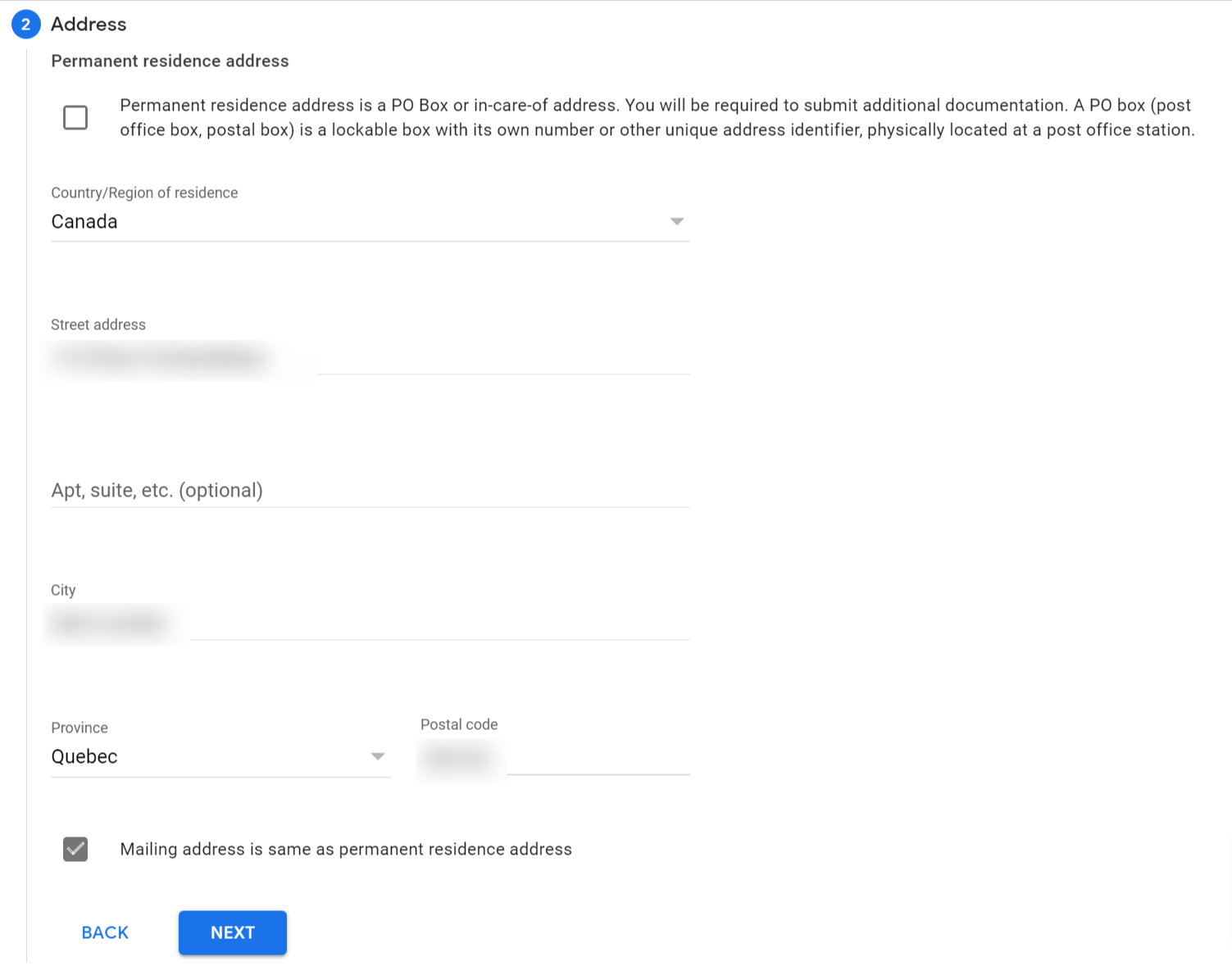

On the followig Step simply add your Address and Mailing Address, you can check the box at the bottom to use the same address for both. If you have a PO Box you will need to provide more information.

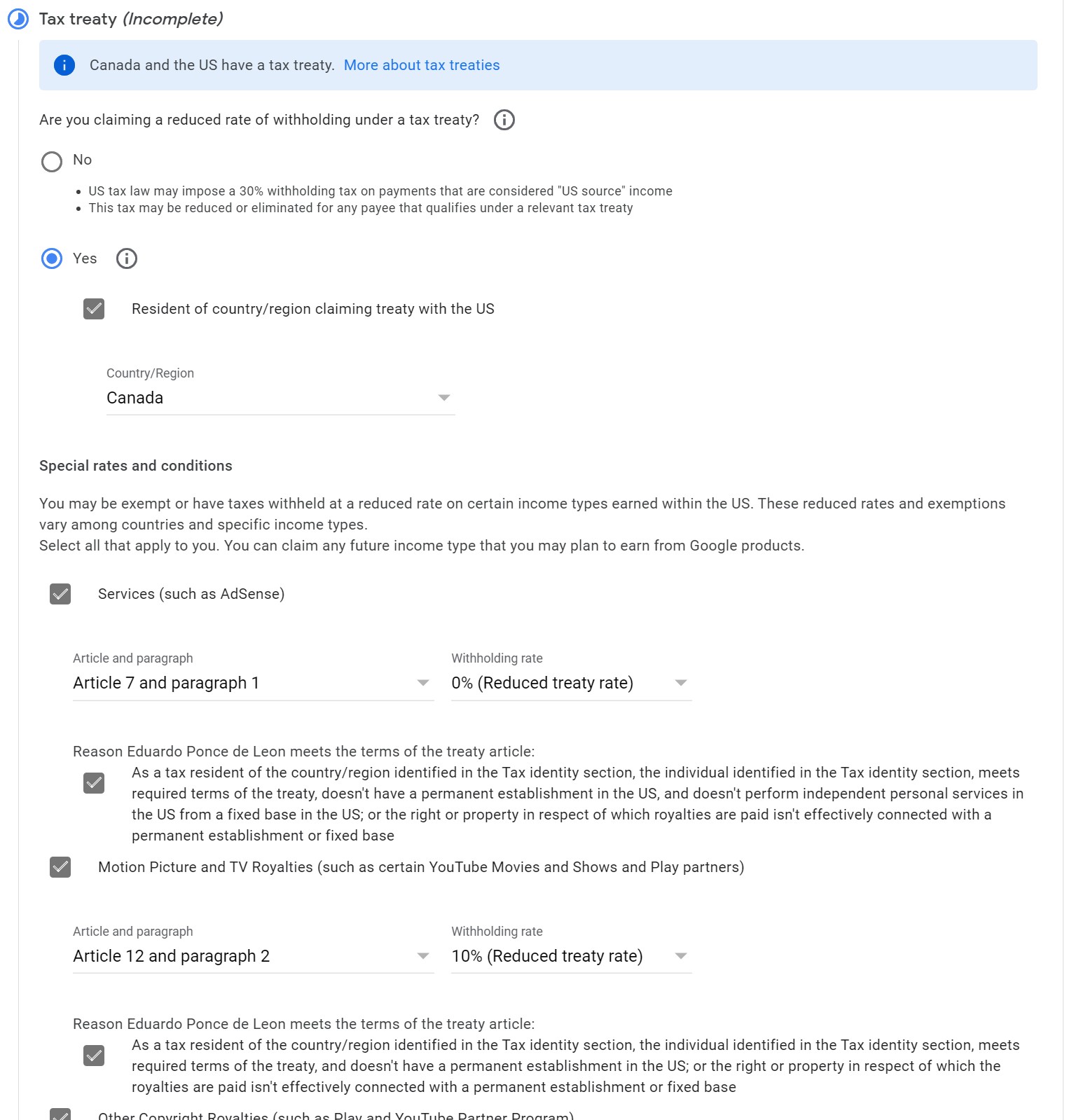

On the next step it is where we will claim for Tax treaty where as Canadians are exempt from paying taxes in the US, or at least pay at a reduced rate.

- Under Are you claiming a reduced rate of withholding under a tax treaty? Select YES

- Check the box that says "Resident of country/region claiming treaty with the US"

- Select Canada as your country / region

- Under Special rates and conditions select the option that best descibes you, if you are only showing ads on your website then Services such as Adsense is for you, but if you create content on youtube then you need Other Copyright Royalties, I recommend selecting all in case you will need them in the future: Services (such as AdSense), Motion Picture and TV Royalties.

- Then Select the Article Paragraph and the smallest withold rate available.

- Finaly Check the boxes that say "As a tax resident of the country/region identified in the Tax identity section, the individual identified in the Tax identity section, meets required terms of the treaty....." And click NEXT

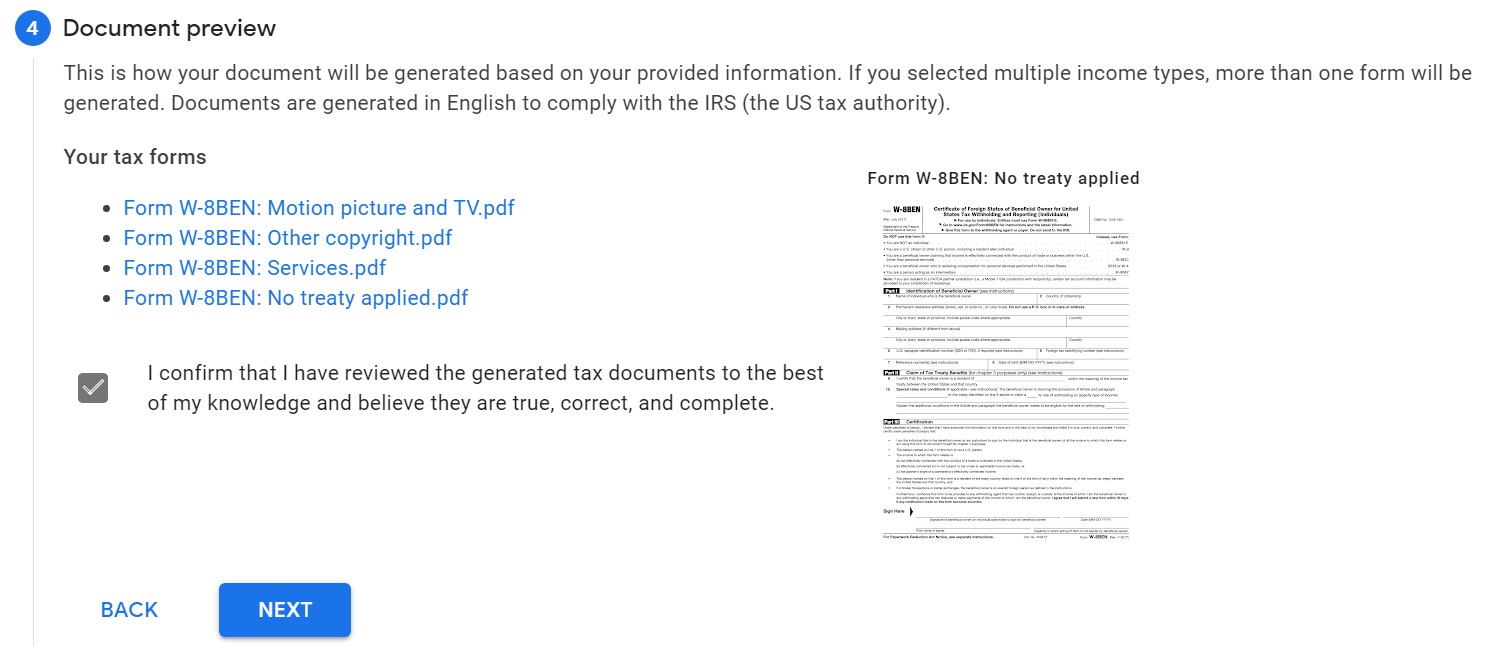

Next you will get a Document Preview where you need to confirm that everything is ok, and click Next

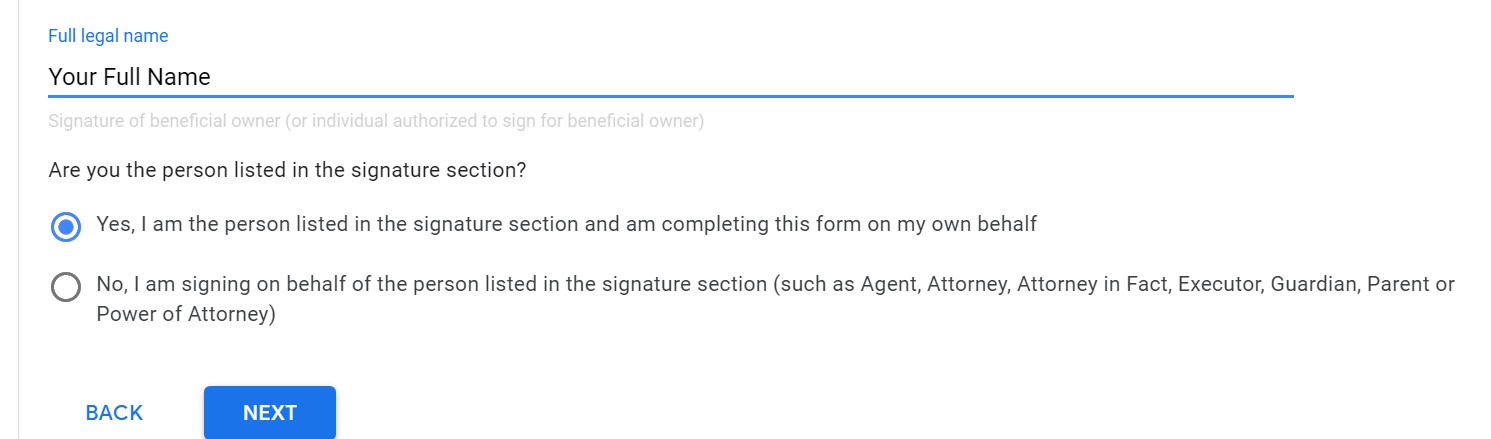

In step number 5, Add your full Legal Name, select if you are the one signing the document or you are doing it in behalf of someone else. and click Next, to make things easier be the one who is signing the document.

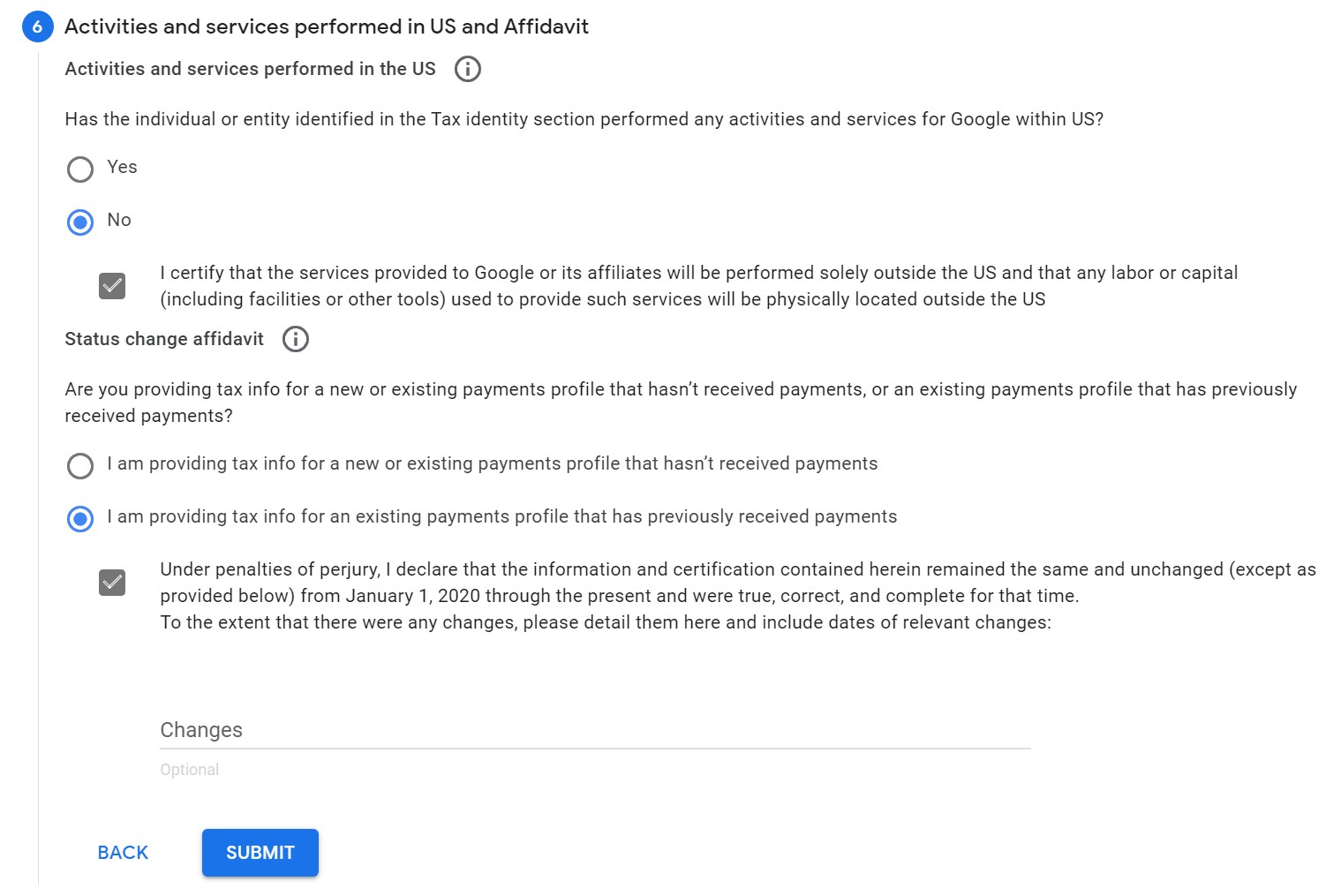

In the last step, under Activities and services performed in the US, select NO if you have not performed any activities for Google within the US, check the box where you certifiy that the services provided will be outside of the US.

Then under Status change affidavit, if this is a new account selecy the first option, but if you have receieved payments from Goole in the past select the second option where it says that "I am providing tax info for an existing payments profile that has previously received payments". Then check the box "Under penalties of perjury, I declare that the information and certification contained herein remained the same and unchanged...." You can leave "Changes" empty, and click SUBMIT

If you liked this article or if you had any issues, leave us a comment below.

Good Luck!

Comments